Simplifying the Customer Journey

for Online Marketplace Payments

Lockdown has become a familiar concept to many people around the world– and stay-at-home measures were extended to millions in the Philippines throughout 2020. But as we’ve witnessed all around the world, the crisis has not impeded payments innovation; instead, in many ways, it has greatly accelerated digital progress.

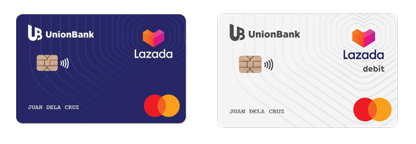

Our client, Union Bank of the Philippines (UnionBank), one of the top ranking banks in efficiency and profitability in the Philippines, further reinforced its leadership in innovation with fast product launches for new co-branded credit and debit cards with Lazada group in 2020 — Southeast Asia’s leading eCommerce platform and the regional flagship of the Alibaba Group.

The UnionBank Lazada [Mastercard] credit and debit cards provide customers with the opportunity to purchase products — touch free from cash — without venturing out from their homes.

To achieve a seamless customer journey, UnionBank enables consumers to apply for the cards through UnionBank Online, its mobile banking app, or online banking website, directly or routed from the Lazada website or mobile app. This API-driven customer journey also allows Filipinos to get timely responses on their applications and subsequently receive instant digital issuance of a virtual card, prior to a physical card, to allow for immediate online spending.

“We are pleased that we were able to quickly bring to market in 2020 the UnionBank Lazada cards, including the country’s first instant issued e-commerce credit cards. With TSYS’ PRIME issuer solutions and APIs, we have benefited from tools that contribute to UnionBank being even more inventive, and fast-to-market and continuing to provide excellent customer experiences,” said UnionBank Consumer Finance Center Head, Senior Vice President Antonio Sebastian T. Corro.

To help cardholders better manage their spend, UnionBank provides a full digital UX where cardholders can view transactions, balance history, rewards and other card-related details plus ‘take actions’ from their mobile banking app or web portal underpinned by many of TSYS’ PRIME APIs.

Although cash accounted for 99% of the country’s total payment transaction volume in 2019, the Philippine e-commerce market is one of the fastest growing in Southeast Asia and the government’s financial inclusion initiatives actively support the rise of card payments.

With exclusive reward benefits for spend at Lazada and other merchants, including up to 6X Lazada credits for every 200 Peso spent at Lazada on credit card and up to 2X cashback for Lazada spend with their cobranded debit card, UnionBank’s recent collaboration demonstrates both a strong value proposition and the technology to empower its customers.

Union Bank of the Philippines (UnionBank) has always been among the first to embrace technological innovations to empower its customers. It embraces the future of banking and is committed to be the Philippines’ leading digital bank to best serve the growing needs of Filipinos everywhere. It has consistently been recognized as of one of Asia’s leading companies, ranking among the country’s top universal banks in terms of profitability and efficiency. It has been recognized as “Best Digital Bank” several times. Determined to be an enabler of the Philippines’ bid to be a G20 country by 2050, UnionBank stands firm in its promise to power the future of banking by co-creating innovations for its customers and for a better world.